Tort, misrepresentation or otherwise arising from the use of these tools/ information contained / data generated herein. To user/ any third party, for any direct, indirect, incidental, special or consequential loss or damages (including, without limitation for loss of profit, business opportunity or loss of goodwill) whatsoever, whether in contract, Neither Axis Bank nor any of its agents or licensors or group companies shall be liable NoĬlaim (whether in contract, tort (including negligence) or otherwise) shall arise out of or in connection with the services against Axis Bank. Axis Bank does not undertake any liability or responsibility to update any data. Other professionals) prior to taking of any decision, acting or omitting to act, on the basis of the information contained / data generated herein.

User should exercise due care and caution (including if necessary, obtaining of advise of tax/ legal/ accounting/ financial/

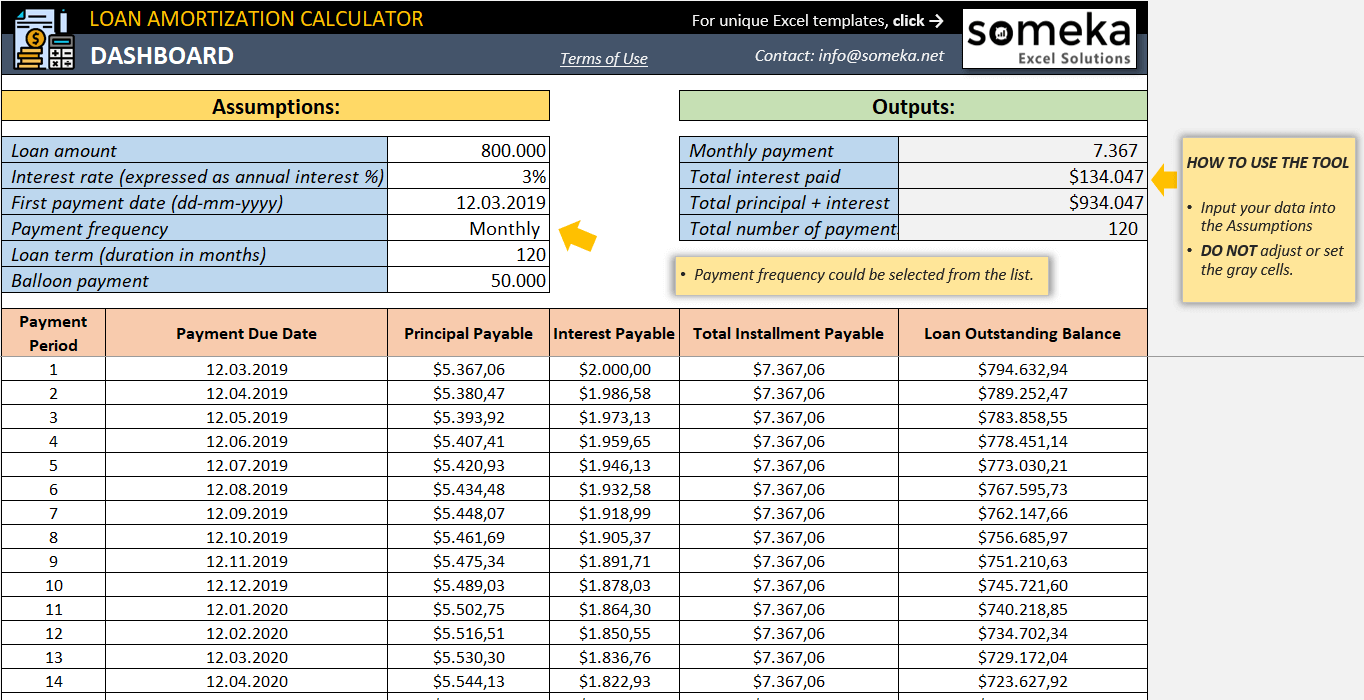

The use of any information set out is entirely at the User's own risk. Herein or on its completeness / accuracy. So, before you apply for a Car Loan, as a prudent loan planning exercise, make it point to assess how much would be the EMI on your CarĪxis Bank does not guarantee accuracy, completeness or correct sequence of any the details provided therein and therefore no reliance should be placed by the user for any purpose whatsoever on the information contained / data generated To make the loan repayment comfortable, you have the EMI (Equated Monthly Instalment) facility. The Car Loan is offered even to proprietorship firms, partnership firms, companies, trusts and societies. You can get a pre-approved car loan, depending on your income and credit score, but subject to maximum loan tenure and the loan amount.Īxis Bank offers Car Loans at an attractive rate of interest, low processing fee, a repayment tenure of upto 7 years, and higher loan-to-value ratio (100% on-road price funding onĬertain models) to purchase a new car. You can simply avail a new Car Loan and drive in your dream car sooner. You don’t need to be wealthy enough or save a fair amount of money to buy your first car, unlike a couple of decadesĪgo. Today, buying a dream car is almost within your reach irrespective whether you are salaried or self-employed.

0 kommentar(er)

0 kommentar(er)